Residential Investment Mortgages

Start or expand your portfolio

Residential investment mortgages are designed for those who are wanting to invest in a residential property that will be let to a third party. Also known as a buy to let mortgage it enables the mortgage repayments to be covered by the rent generated by the tenant, usually through an Assured Shorthold Tenancy (AST). For a standard buy to let the residential property is a straightforward single unit property such as a flat, terraced house, semi-detached or detached house and is occupied by one household such as an induvial, couple or family.

Residential investment mortgages can be used for a variety of purposes, including purchasing a new Buy to Let property, raising capital against an existing portfolio to enable you to raise a deposit contribution for further purchases, refurbish existing properties or releasing equity for your other business requirements.

Know your Rental Income

It is important to understand what your rental income needs to be. Although lenders will have maximum loan to value limits that they are willing to lend against, it is often the rental income that is the most important consideration determining how much you will be able to borrow and whether a loan is affordable. Typically, residential investment mortgage lenders will expect the rental income to be at least 125%-140% of the monthly repayments on your mortgage for the loan to be granted. This is called the interest coverage ratio (ICR)

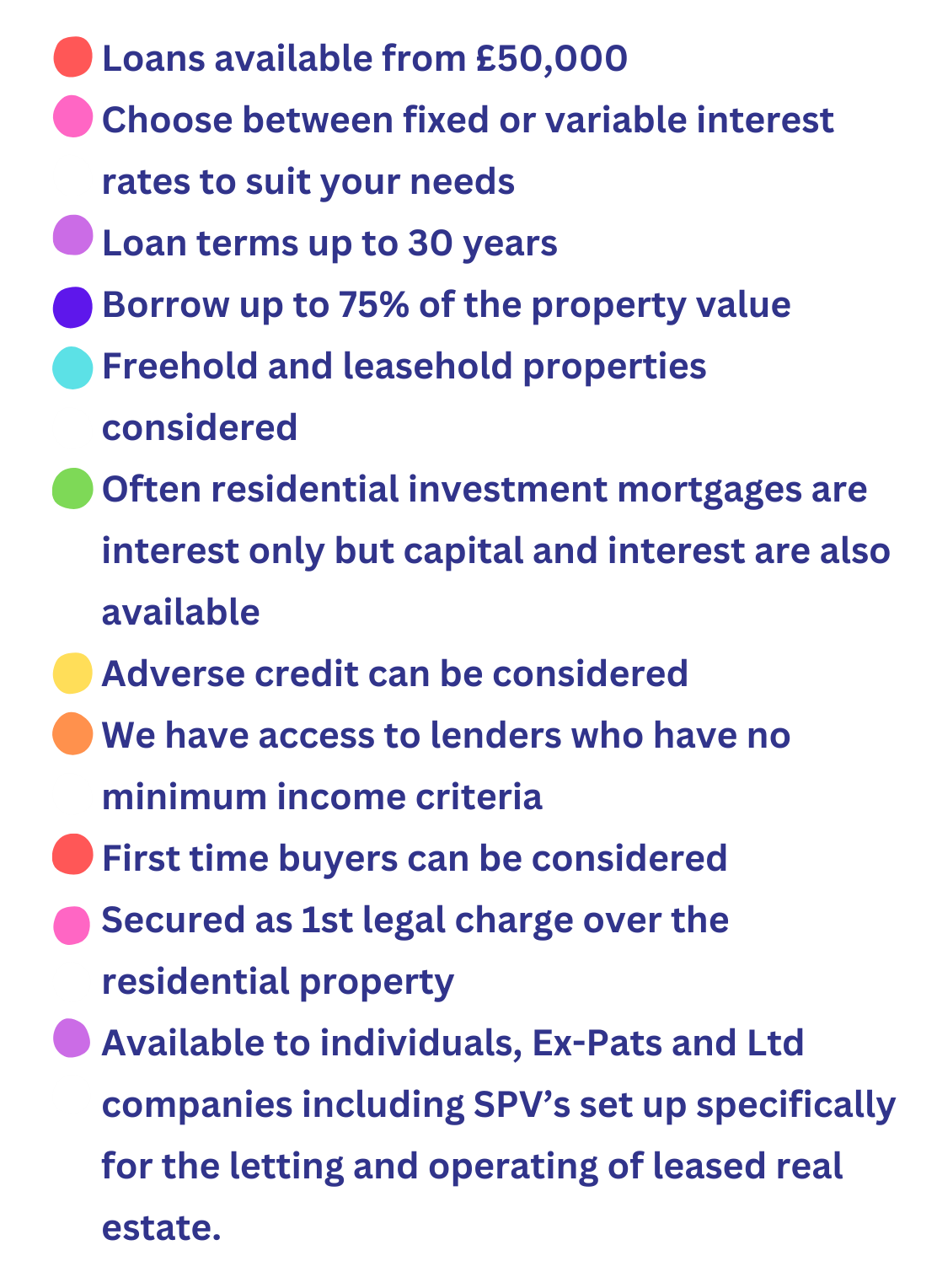

What are the benefits of residential investment mortgages?

MUFB's

An MUFB is a Multi-Unit Freehold Block and is defined as multiple, separate, independent residential units held under a single title. It includes purpose-built blocks of flats, houses converted into flats and a number of houses all held under one freehold title. Each unit/property on the title must be self-contained with a kitchen, bathroom, living space, bedroom(s) and its own private entrance and independent utilities. Each unit within the MUFB will also have its own AST agreement. MUFBs have a greater capacity for increased rental yield compared to a standard single occupied BTL investment property because multiple tenancies provide enhanced income opportunities and help smooth out cash flow to cover rental voids.

Portfolio Landlords

If you have 4 or more mortgaged buy to let properties, you will be classed as a portfolio landlord. Portfolio landlords are usually subjected to additional stress tests which include stressing the rental cover of the whole portfolio and not just the property that you are buying or refinancing. You can also obtain a “portfolio loan” which encompasses several properties at once and provides benefits including cost savings. Lenders will usually require a property portfolio spreadsheet detailing any current mortgages, rental income, and property details such a number address and number of bedrooms.

HMO's

HMO (House of Multiple Occupation) is used to describe a property which is rented out to at least three people who are not from one household but share communal facilities such as the bathroom and kitchen. A household is classed as a property used by couples who are married/living together, a single person, families or relatives. HMO’s are frequently referred to as ‘house shares' and include students renting one house or workers sharing a house. HMO properties can be a popular choice for landlords as they offer greater rental yields compared to a standard buy-to-let property and because HMOs have multiple tenants a rental income void is less likely.

If you are looking to start or grow your property portfolio, then get in touch with us today to see how we can help find the right financial solution for you.