Commercial Mortgages

Helping your Business Grow

Does your business operate out of a rented property, or have you outgrown your current premises?

By taking out a commercial mortgage either in your name or your businesses name you could purchase your own property to trade from or purchase something bigger. It can be a great way of securing your businesses future where you’ll benefit from any increase in the property’s value, and you won’t have the constraints of renting.

Or do you already own property for your commercial business and need to raise funds?

We can help you re-finance your commercial mortgage to unlock the equity within your commercial property. This can then be re-invested into your business, whether it be providing cash to fund a project such as modernising productions lines, consolidating existing credit commitments, purchasing additional business premises or providing cashflow for business expansion.

On the other hand, maybe you are simply unhappy with your current deal and are looking for a more competitive or appropriate commercial mortgage product.

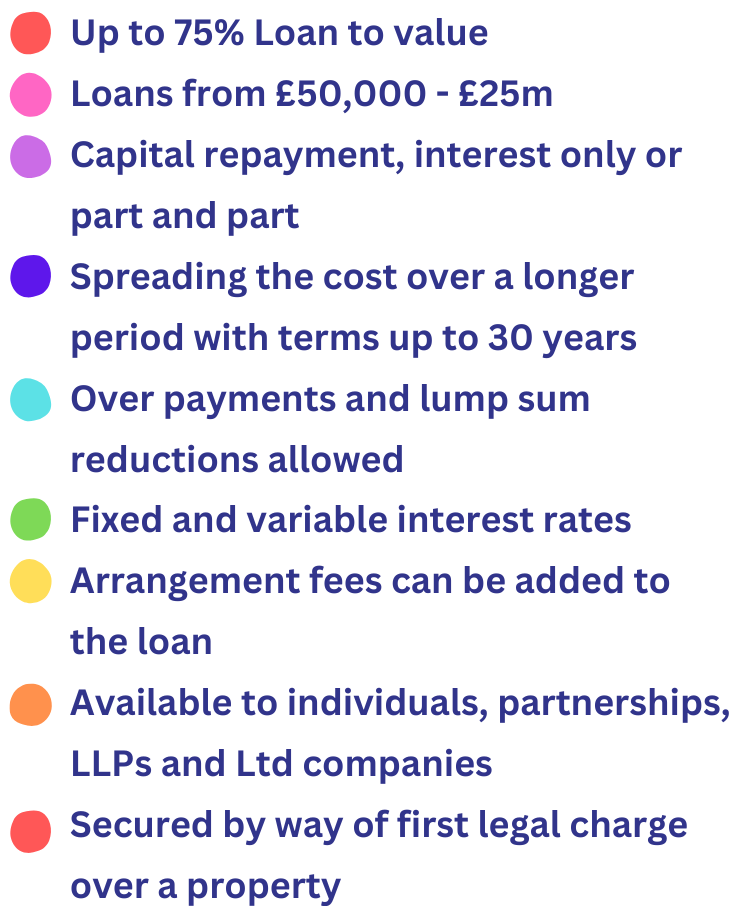

Key Features

Types of Commercial Mortgages

Commercial Mortgages

Commercial mortgages are for properties where the whole property is used for business purposes.

Semi-Commercial Mortgages

A semi-commercial mortgage is where there is a combination of both commercial and residential use.

Trading Business Mortgages

Trading Business mortgages are available where the property along with the business is being purchased. This can include goodwill, fixtures and fittings.

What Types of Property can be Used?

A commercial mortgage can be secured against the following types of properties.

Key Considerations

On top of the loan to value, we will look at your ability to repay the debt.

When assessing commercial mortgages, the strength of your business and its financial accounts will provide the answers we need to assess the maximum level of debt and the size of the commercial mortgage you can obtain.

Essentially your business needs to be able to afford the monthly mortgage repayments from business turnover or profits after dividends, drawings and day to day living expenses have been deducted.

Whatever your reason for requiring a commercial mortgage, get in touch with us today to see how we can help you find the right solution for your business requirements.