Divorce Loans

Specialist loans to see you through a divorce

Divorce can be expensive and disruptive to your finances. It is often difficult to access capital during divorce proceedings, but divorce loans are designed to bridge this gap until a settlement is achieved, helping you get your financial situation back on track.

Divorce loans mean you don’t need to have the funds on hand to cover the legal and other associated costs of divorce, enabling you to access the advice you need to achieve a fair settlement. You can use your divorce loan to pay for the whole of your legal fees, cover court costs and fees, pay for mediation or arbitration or fund expert reports such as a forensic account or a surveyor.

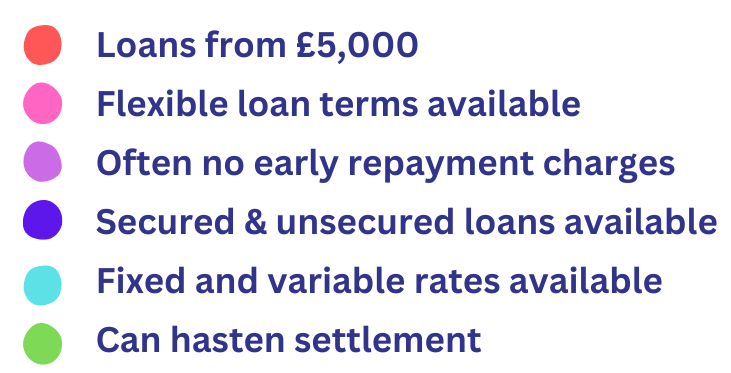

Key features of divorce loans

What are the Benefits of Divorce Loans?

Hire better representation

Taking out a loan opens you up to more options for your legal team so you can build the best possible defence for your case.

Maintain your lifestyle

If your former spouse has hold of most of your assets, a loan can also help fund your reasonable living expenses until the end of your case.

Level the playing

field

Where one claimant who has little means is faced with a defendant who has substantial or unlimited means, a loans can help level the playing field.

No monthly repayments

Usually the loan is only repaid at the end of the case, meaning you don’t have to pay anything until you’ve received your settlement.

If you are looking to finance your divorce then get in touch with our team today to see how we can help.