Bridging Loans

Flexible short term property backed finance.

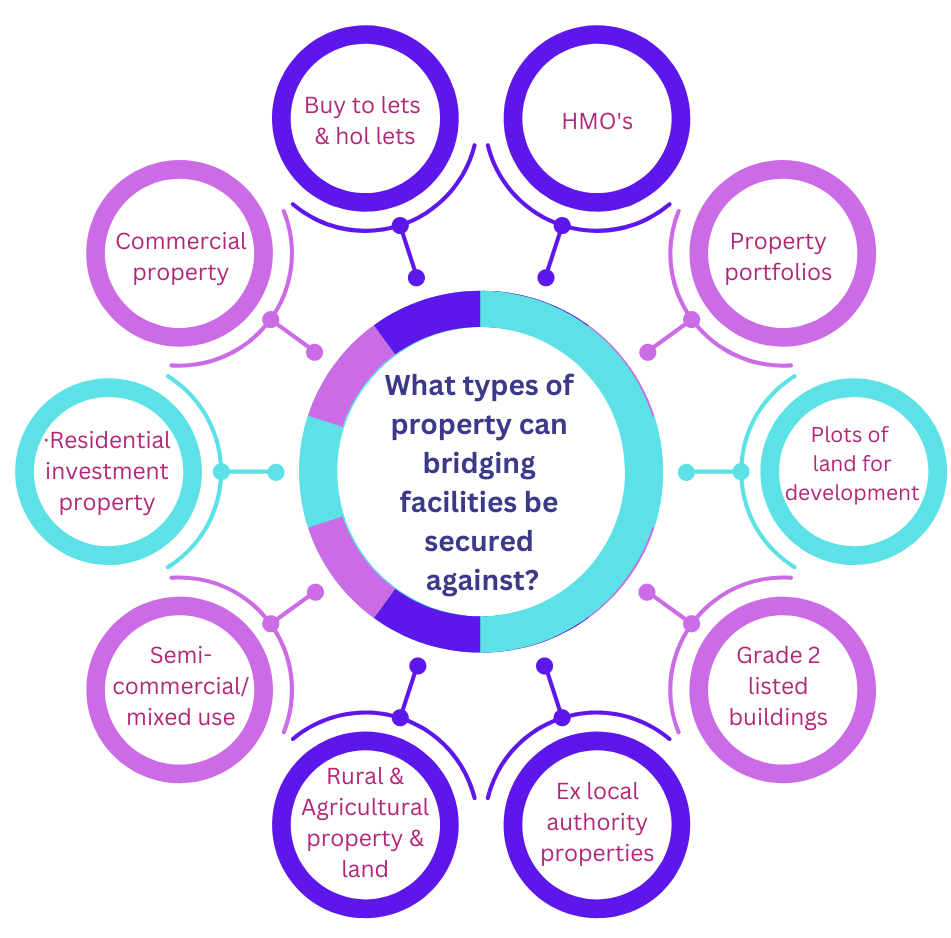

Short-term secured finance, traditionally known as bridging finance, is a way of raising funds quickly for those financial needs that are urgent and temporary until longer-term finance is available or the asset sold to exit the loan. Bridging loans are normally secured by property or land.

Why would you use a bridging loan?

There are many reasons individuals and companies make use of bridging loans:

What are the Benefits of Bridging Loans?

Tailored

Terms to suit you from 1 to 36 months

Flexible

Loan to Values of up to 75% . 100% funding available with additional security provided

Accessible

Access finance from

£50,000 to £20m

Affordable

The monthly interest repayments can be rolled up & repaid at the end of the term along with the capital, therefore no monthly repayments

Speed

Quicker than a traditional mortgage

Security

Loan secured against the property/land with first and second charges available

Key Considerations

Exiting a Bridge Loan

A crucial factor to consider with this type of lending is the exit strategy. As the cost of a bridging loan can be higher than a more traditional loan, a bridging lender will want to see evidence of a clear repayment strategy, such as the sale of a property or approval of new term loan to clear the bridging loan.

Bridge to Let

A Bridge to Let loan is where a pre-approved exit strategy is included in the facility. The initial bridging loan is used to purchase and sometimes develop a property. Once the property is purchased and tenanted the loan is then transferred to a Buy to Let or investment mortgage with the same lender.

This is a popular type of facility because it saves you the time and hassle of having to apply for a bridging loan and a Buy to Let mortgage with two separate lenders.

If you are considering a bridging loan, see how we can help by contacting us today to discuss your requirements. We can save you time and money by using our experience, and access to our lending partners to get the best fit for your proposal, whilst guiding you through every step of the process.