Development Finance

Turn your building ideas into reality.

Property development finance is a short-term loan which provides money specifically for property development, secured against the property development site itself. Such loans can provide a lump sum towards the purchase of the land or property, followed by a specific amount made available to cover the costs to complete the project and any associated professional fees and other costs.

The principle is that the lender will provide funds at pre-determined stages of construction and up to an agreed maximum amount, with the funding being repaid from the proceeds of sale of the completed property or refinance. The tranches are often paid in arrears so the developer would have to cash-flow the onset of the works, and the lender will then reimburse these costs at the pre-defined stages.

Lenders typically work to the gross development value (GDV), this is the end value of the development once finished and any funding agreed will be a percentage of this figure.

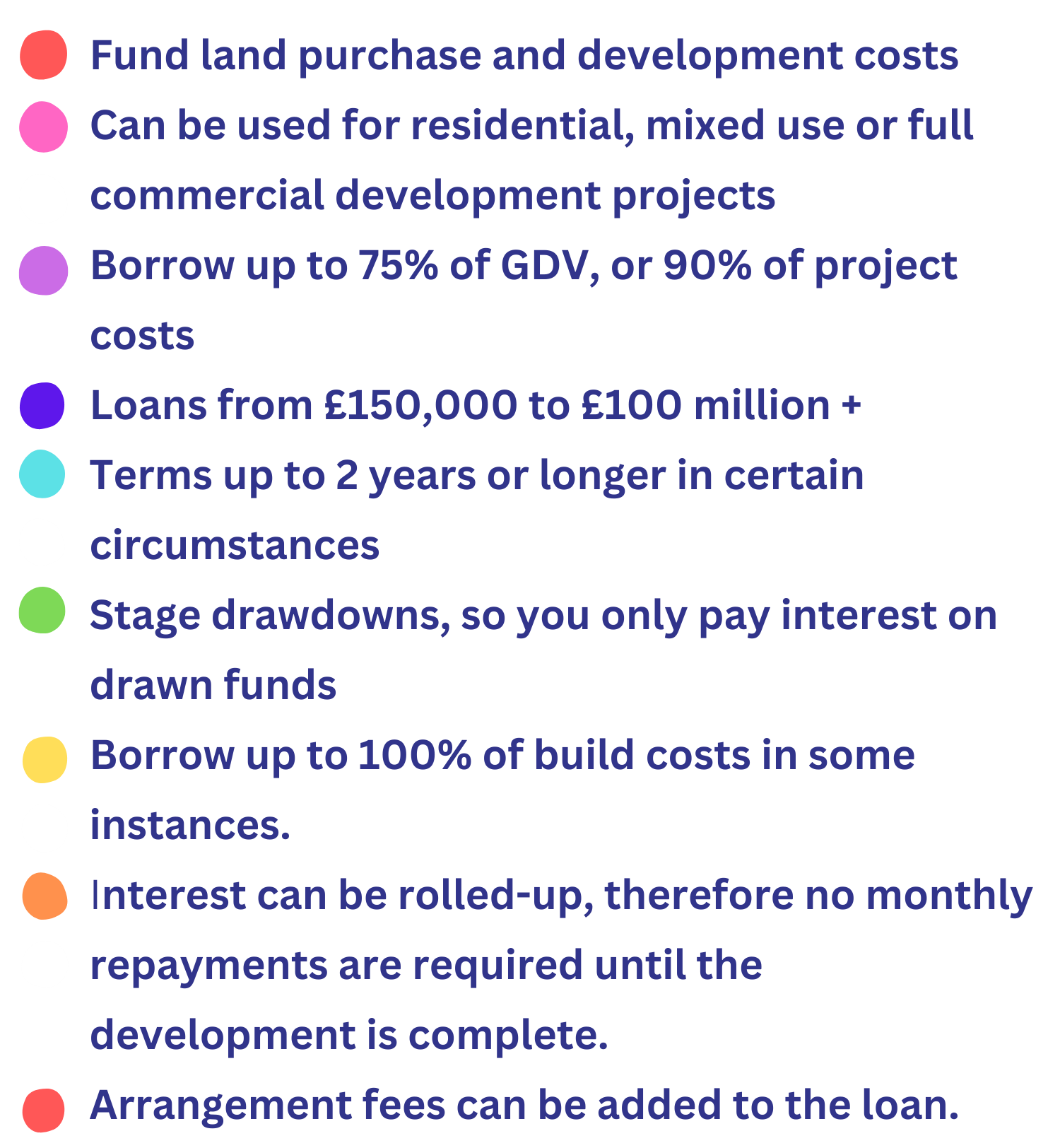

Key Features and Benefits

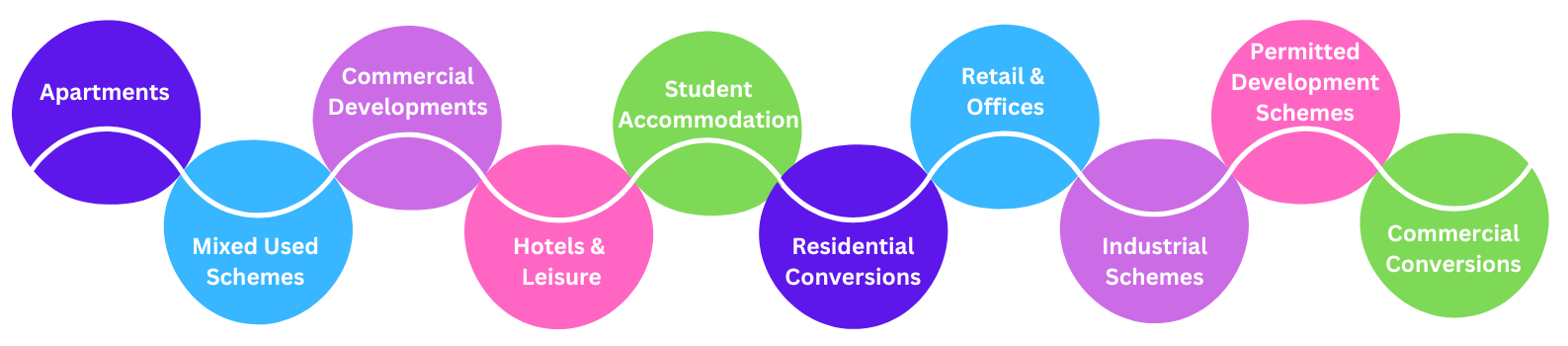

What can I use Development Finance for?

The most common use is for housing developments from single units to large sites. It can also be used to finance:

Mezzanine Funding

Mezzanine property development finance is used to help bridge the gap between the maximum development loan, and the amount of equity or funds that a developer has to invest into the development. It can increase the overall funding available for the total development costs including site purchase. The Mezzanine Lender will need to take a second charge on the land and the development, sitting behind the first charge or the ‘senior debt provider’ development finance lender. It is essential for developers to be experienced, to access mezzanine finance.

Development Exit Funding

Development exit funding is designed for residential or residential led mixed-use property where an extension of time is required to bridge the gap between completing the development project and selling the completed property or properties, equity release as a cash contribution to a new scheme or stabilisation of rental income.

What information would I need to provide?

For our funder partners to properly assess a project they will need to see a range of information. This includes, but is not restricted to:

Property development curriculum vitae (CV)

Lenders like to see some previous involvement in a project – however small – that has been successful and profitable.

Planning permission

Copies of approved planning permission will be required along with accompanying plans/drawings

Costs

Detailed build costs will be required including contingency funds, potential yield from the project and a schedule of works

Details of the professional team

Details of contractor, architect, structural engineer, CDM co-ordinator will be required or will you be building yourself, using your own team?

Any information to support the proposed GDV

This can include information on any comparable sales and rental figures as well as estate agents’ opinions.

Future Intentions

If properties are to be retained on completion, an agreement in principle for a refinance facility will need to be in place.

How do I get property development finance?

That’s where we come in. Once we have established your requirements and the case specifics, we can very quickly funnel down the options. So, whether you are looking for the cheapest rates, or the highest leverage, we can help secure the best funding package to make your development a reality.