Green Loans

Here to help your business aim to finance assets to support their sustainability ambitions.

What are Green loans used for?

Green loans are a specific type of loan dedicated to focusing on helping business becoming greener. Green loans help businesses evolve into low carbon emissions or net-zero businesses to reduce the impact on the planet. This can be implemented via cleaner energy supplies such as solar panels, using electric vehicles, or heat pumps on commercial buildings.

What is Global warming and Climate change?

During the 1970s,scientists identified that just over half of the effects of climate change are due to humans producing CO2.This increased the problem of the Greenhouse Effect. This is when the global temperature is rising due to pollutant gases in the atmosphere trap radiating heat from Earth, as well as reflected infrared waves from space, causing the atmosphere to heat up. This is leading to changes in the global climate system, causing more extreme weather events, sea-level rise, and damage to ecosystems. For example, Antarctic ice shelves have lost nearly 4 trillion metric tons of ice since the mid-1990s, with warming ocean waters melting them faster than they can refreeze. This has lead to wildlife struggling for shelter and habitats in Antarctica.

Why are Green loans becoming a bigger thing?

Green loans have come in place to help business reduce their impact on the world. For example, by using cleaner energy supplies it means that less CO2 is being emitted into the atmosphere. Helping slow down the rate of global warming and climate change.

Why would you need a Green loan?

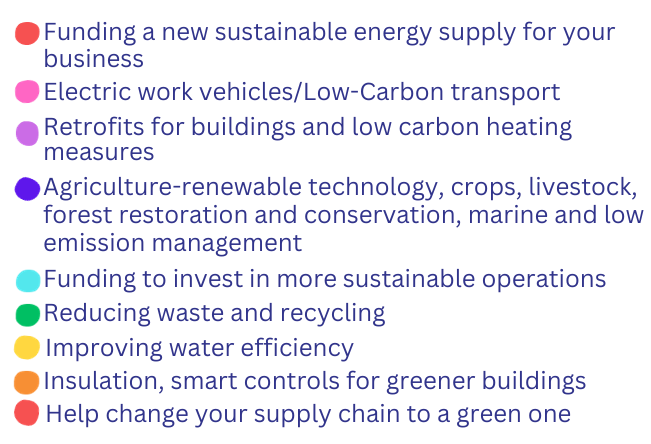

Many people are looking for a way to finance their new endeavours into sustainability. We can help you with:

Loan Features

Interest rate

If you decide to cancel a fixed interest rate, you may have to pay breakage costs

No Arrangement Fees

No arrangement fees on your loan when you put the loan money towards buying eligible green assets.

Accessible

Borrow from £25,001 up to £10m on a fixed interest rate or no upper limit on a variable rate, subject to approval

Flexibility

Repayment terms from 3 months up to 25 years

If you are looking for a way to finance your business into a more sustainable business world, get in touch with us today to see how we can help find the right solution for you to Go Green with your business.